Expertise

A unique model, built on four complementary and synergistic areas of business

As the leading independent investment bank in Italy, we offer a broad range of financial services that include M&A and corporate finance advisory, access to capital markets, insights on financial markets, trading ideas and investment solutions, in Italy and abroad, assisting clients and partners with their financial projects and strategic initiatives.

Research is at the center of the strategy. Clients can get access to a leading trading floor constantly connected with financial markets globally, a successful investment banking team that has a strong track record in the execution of complex transactions, and an independent multi-asset management platform which successfully manages alternative asset classes investing in private debt, private equity, infrastructures and renewables.

Investment Banking

The only truly independent one-stop-shop in Italy, capable of meeting all financial needs of entrepreneurs, corporate issuers and financial institutions

Our Investment Banking team is made up of committed and expert professionals, with a proven track record in the execution of strategic transactions and a multi-disciplinary, deep know-how. We offer a complete range of products and services addressed to listed companies, corporates, entrepreneurs, financial institutions and investors.

In the recent years, the team has diversified its offering, thanks to senior hirings dedicated to new verticals, and has further consolidated its sectorial expertise (industrial, consumer, structured finance, real estate...) to assist clients with tailor made solutions and outstanding out-of-the-box thinking.

Our solutions

Crossborder M&A

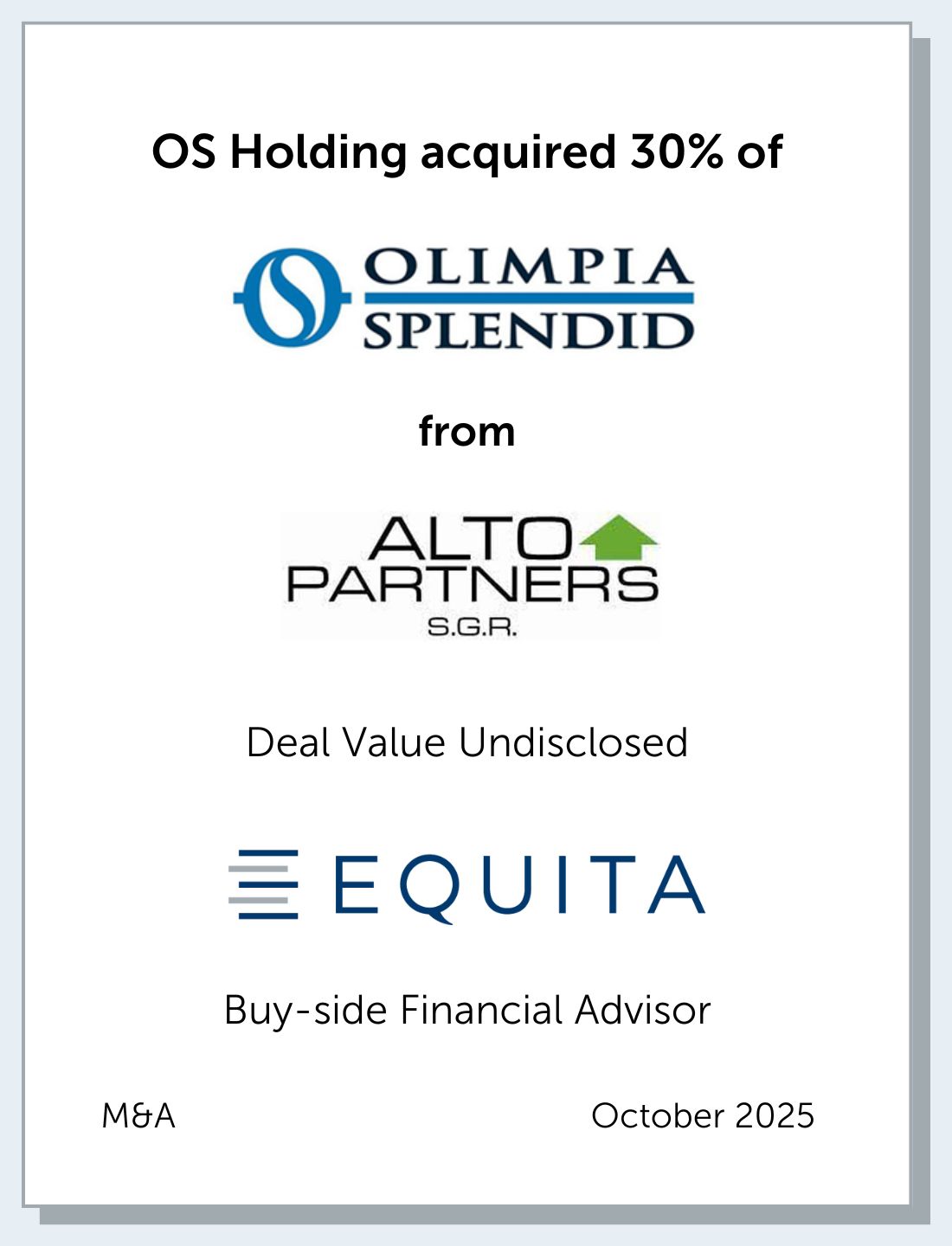

Thanks to the constant collaboration among hundreds of international professionals and the continuous dialogue with Clairfield partners, EQUITA has strengthened over the years its ability to advise large corporates, family businesses and investors in crossborder transactions, especially in the midmarket segment, and consistently ranks among the top ten financial advisors in Italy.

Key People

EQUITA SIM

Marco Clerici

Carlo Andrea Volpe

Simone Riviera

EQUITA Mid Cap Advisory

Giuseppe Renato Grasso

Filippo Guicciardi

EQUITA Debt Advisory

Fabio Cassi

Fabrizio Viola

EQUITA Real Estate

Silvia Rovere

Global Markets

The largest independent trading floor in Italy, offering its best-in-class services to investors, financial institutions and issuing companies

Our trading floor offers third-party brokerage services (Sales & Trading) and proprietary trading services on behalf of clients (Client-Driven & Market Making). Financial instruments covered space from equities to fixed-incomes, from certificates to derivatives and ETFs. Clients get access to the most important global trading venues and appreciate our flexibility in building the right strategy on markets.

The division is composed by smart, market-oriented sales and traders. Everyday the team interacts with more than 500 institutional clients all around the globe and more than 70 financial institutions and banking groups to execute the investment strategies of their retail clients.

Our solutions

Key People

Vincenzo Abbagnano

Cristiano Rho

Fabio Arcari

Sergio Martucci

Simona Pozzi

Research

We support institutional investors' decisions with unbiased insights on global financial markets and outstanding research with in-depth analysis of listed companies, especially on mid-small caps

Our equity and fixed income research stands out for its in-depth analysis and quality, as well as for its expert analysts who have been consistently at the top of international rankings for many years.

Full independence, deep understanding of industry trends and fundamental analysis, very broad coverage, both in terms of market capitalization of issuing companies and sectors, is what we offer to investors, in addition to a strong knowledge of sustainability and ESG.

Our solutions

Key People

Luigi De Bellis

Domenico Ghilotti

Alternative Asset Management

One of the leading multi-asset managers in Italy, offering long-term capital, managerial skills and industry competences

We are a fast-growing asset management platform, mainly focused on alternative, illiquid strategies and built on the expertise of high-standing professionals with decade of experience in liquid and illiquid markets.

Our purpose is to help institutional investors with innovative solutions in private debt, private equity and renewable infrastructures.

We also provide niche-investment products to banking groups, financial institutions and private banking networks for their retail clients.

Our asset classes

Key People

Paolo Pendenza

Stefano Lustig

Head of Liquid Strategies

Matteo Ghilotti

Rossano Rufini

Balthazar Cazac

Senior Advisors

John Andrew

Paolo Basilico

Fabio Cassi

Stefano Mainetti

Gianfilippo Mancini

Roberta Neri

Thierry Porté

Silvia Rovere

Paul Schapira

Fabrizio Viola

Recent Credentials

QUICK LINKS

Are you interested in the latest news and deals, information about the EQUITA stock or official press releases? Click on the quick links below!

If you are interested in a specific legal entity of the EQUITA Group, visit the dedicated website.