Business

Capital Markets Yearbook - 2025

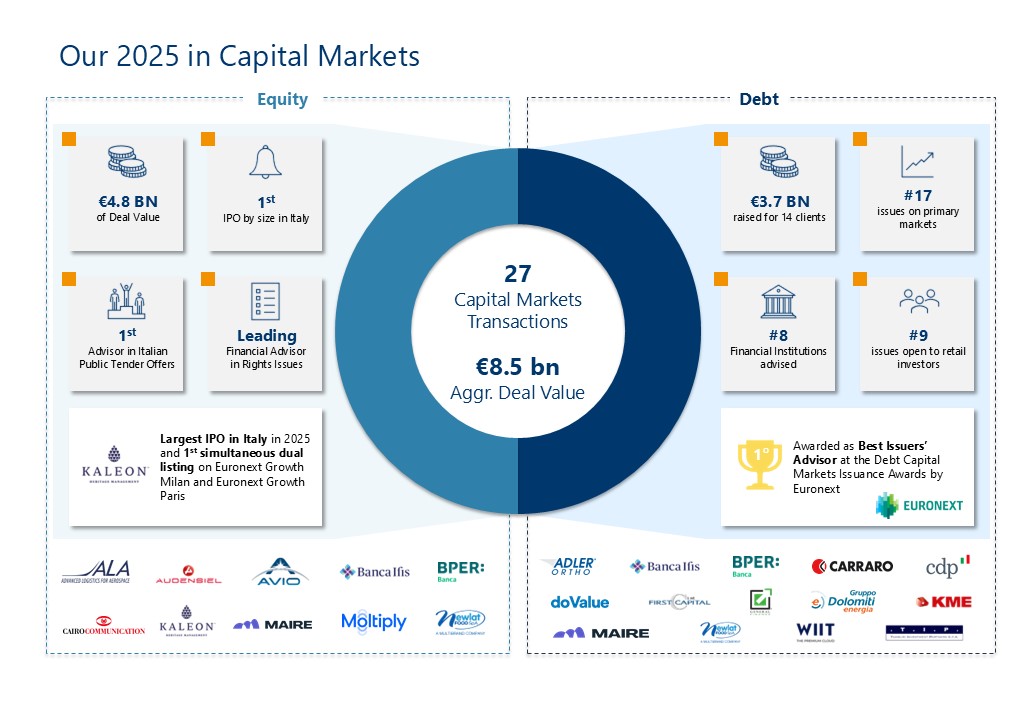

EQUITA, the leading independent investment bank in Italy, confirmed its leadership in Italian Capital Markets with a very successful 2025: 27 transactions completed, with a total deal value of €8.5 billion.

Equity Capital Markets

-

10 deals closed (3 ABOs, 1 IPO and 5 Public Tender Offers and 1 Rights Issue)

-

€4.8 in deal value

-

The largest IPO in Italy and the 1st simultaneous dual-listing on Euronext Growth Milan and Paris

-

#1 advisor in Italian Public Tender Offers

Debt Capital Markets

-

17 bond issues where EQUITA acted as Placement Agent, Joint Bookrunner, Leading Agent, Joint Lead Manager, Co-Manager or Arranger

-

€3.7 raised on the market

-

#8 Financial Institutions advised

-

#9 issues open to retail investors

-

Best Issuers’ Advisor at the Debt Capital Markets Issuance Awards by Euronext