About us

The leading Italian investment bank

As the go-to partner of investors, institutions, listed companies, corporates and entrepreneurs, EQUITA acts as broker, financial advisor and alternative asset management platform by offering a broad range of financial services that include M&A and corporate finance advisory, access to capital markets, insights on financial markets, trading ideas and investment solutions, in Italy and abroad, assisting clients with their financial projects and strategic initiatives.

Drawing on more than half a century of experience, EQUITA is committed to promote the role of finance by creating value for the economy and the entire financial system, thanks to its deep understanding of markets, strategic transactions, and sustainability.

A unique business model, where research is at the core of the strategy and where clients get access to a leading trading floor constantly connected with financial markets globally, a successful track-record in the execution of investment banking transactions – enhanced also by the international partnership with Clairfield who identifies cross-border opportunities for Italian and foreign companies – and a proved expertise in the management of investment funds, especially in illiquid asset classes like private debt, private equity, infrastructures and renewables.

EQUITA stands out for its independence and integrity, the commitment of its professionals to best-serve clients, and the concept of “partnership” that sees its managers and employees as shareholders of an investment bank listed on the Italian Stock Exchange as “STAR” company.

Group Structure

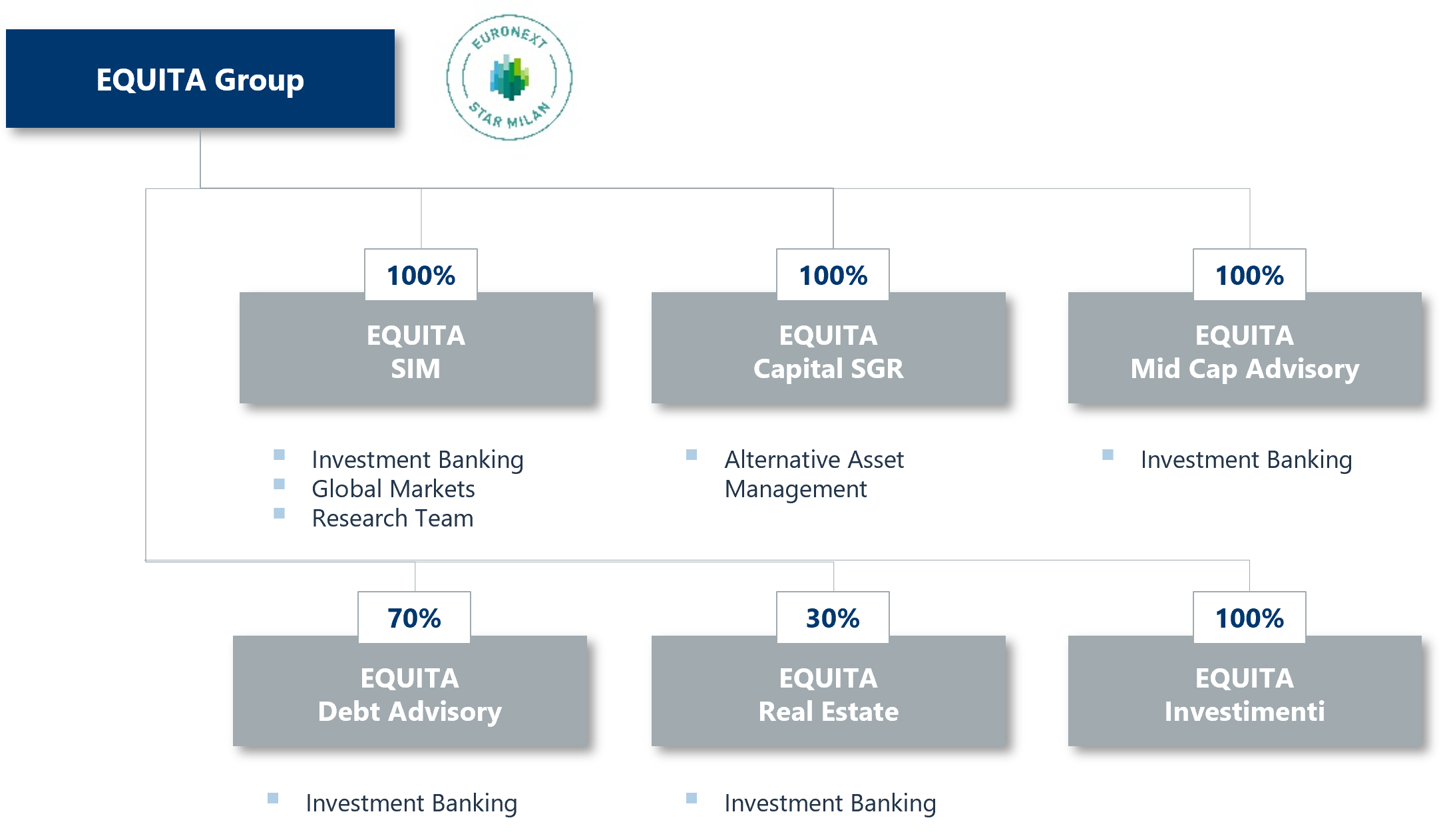

The Group is managed by EQUITA Group S.p.A., parent company listed on the Italian Stock Exchange.

Despite its simplicity, the Group structure allows EQUITA to assist efficiently - and with a high degree of flexibility - all types of clients, in every situation, also avoiding conflicts of interest.

Business is formally carried out by the operating legal entities EQUITA SIM, EQUITA Capital SGR, EQUITA Mid Cap Advisory, EQUITA Debt Advisory, EQUITA Investimenti, EQUITA Real Estate, each of them positioning among leading players in the respective underlying markets.

Learn more

50 years of independent thinking

Founded in 1973 under the name of Euromobiliare, EQUITA has a long tradition in the market as an independent investment bank. For decades, the Group has confirmed itself among the leading brokers and financial advisors, thanks to its direct involvement in the most significant financial transactions completed in Italy in the last 20 years.

Our Entrepreneurial DNA

Our DNA is based on independence, entrepreneurship and the concept of partnership among professionals. Managers and employees are invested in the share capital of EQUITA and this aligns interests with investors and clients, nurturing a long-term view.

Values

Independence, loyalty to clients, competence, expertise, excellence and entrepreneurship are some of the founding values that guide our actions daily

Mission

Every day we build long-term alliances with our clients by offering independence, financial expertise and best-in-class solutions

Vision

We are committed to broaden the range of products and services to advise clients and position EQUITA as the go-to partner in any situation

Values

Independence, loyalty to clients, competence, expertise, excellence and entrepreneurship are some of the founding values that guide our actions daily

Mission

Every day we build long-term alliances with our clients by offering independence, financial expertise and best-in-class solutions

Vision

We are committed to broaden the range of products and services to advise clients and position EQUITA as the go-to partner in any situation

Our People

"Passion in financial markets and finance in general, teamwork and attention to clients: that is what shapes our behavior... every day"

People are our greatest asset. We offer corporate welfare programs which provide monetary and non-monetary benefits, along with a pleasant and more productive work environment.

We also invest in the development of careers and training of all professionals, from the junior to the senior ones. Young people are the future of both EQUITA and the community, and that is why their education and the development of their talent is a priority for us.

Our Commitment to Sustainability

Sustainability is consistently integrated into the EQUITA business model. Our services dedicated to sustainability include investment products on infrastructure renewables, financial advisory in the issue of green and sustainability-linked bonds, ESG research reports, events and conferences dedicated to hot topics, and much more.

EQUITA provides access to a dedicated sustainable finance team and the main purpose is to assist investors, corporates, entrepreneurs and institutions with new solutions and products dedicated to sustainable finance. The Group is strongly committed to help clients with the delicate task of integrating sustainability into their business models.

EQUITA is also constantly involved in innovative sustainable finance initiatives and is a former member of the Sustainable Finance Partnership of Borsa Italiana - Euronext.

Fondazione EQUITA

We have always been alongside the community with dedicated initiatives focused on supporting local areas, social cohesion and integration, as well as promoting culture under different aspects, from art to financial education. Nurturing talent and aspirations of young students, helping local communities and aiding most fragile people are concrete actions in line with the EQUITA principles and founding values.

Starting from 2022, this effort has increased significantly, following the establishment of Fondazione EQUITA, non-profit organization founded by EQUITA and senior professionals of the Group.

Local communities, social cohesion and integration, promotion of culture and financial education are only a few of the areas where Fondazione EQUITA is committed. Visit the official website to know more.

Visit the official website of Fondazione EQUITA

Awards

Thanks to the unwavering commitment of all the Group's professionals, who are always looking for effective solutions for clients and partners, EQUITA has been at the top of international rankings and surveys in the Italian market for years.

QUICK LINKS

Are you interested in the latest news and deals, information about the EQUITA stock or official press releases? Click on the quick links below!

If you are interested in a specific legal entity of the EQUITA Group, visit the dedicated website.