The transaction in a nutshell

- Client:

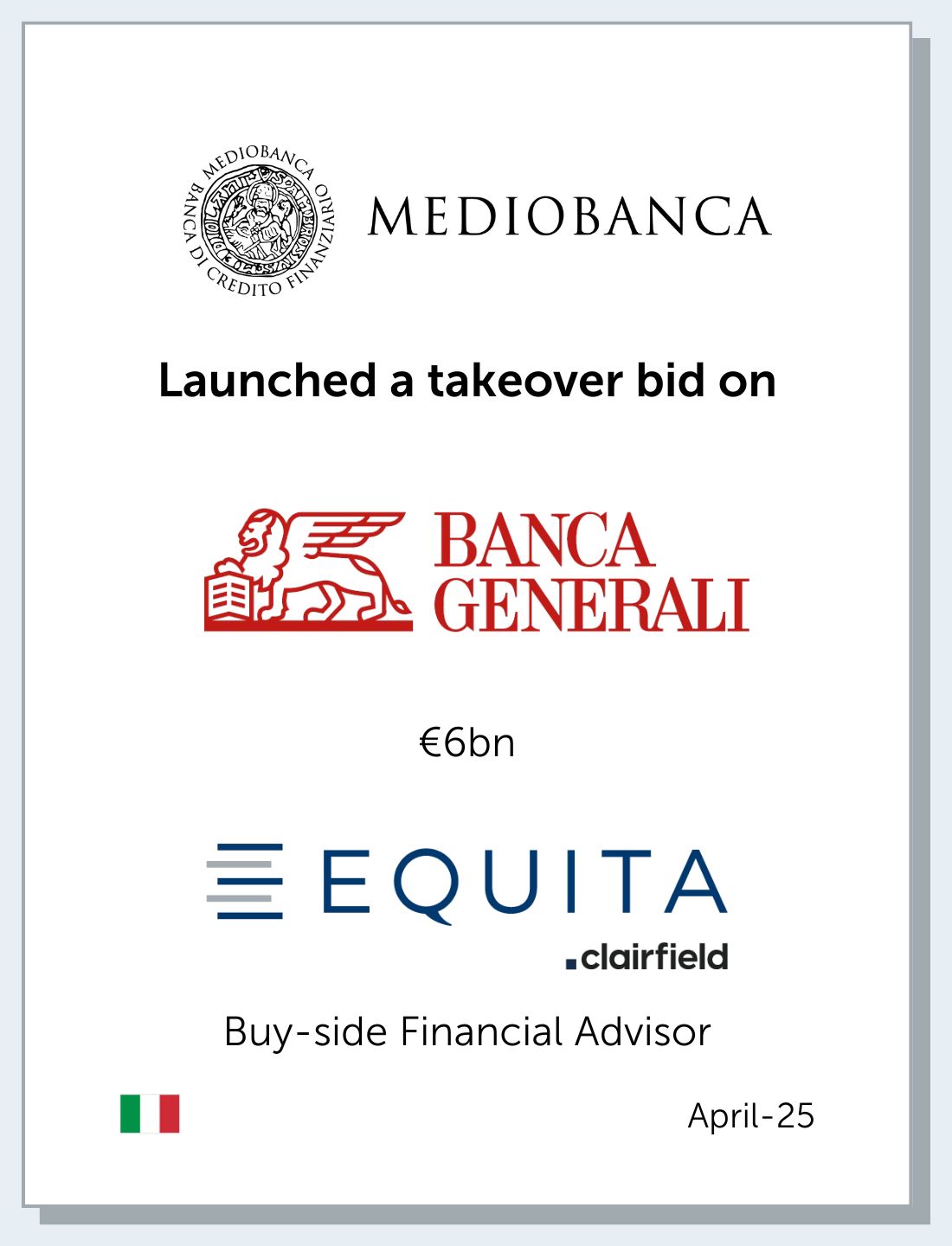

- Mediobanca S.p.A.

- Date:

- April 2025

- Mandate:

- Takeover bid on Banca Generali

- Role:

- Buy-side Financial Advisor

- Value:

- € 6000 m

- Team:

- M&A advisory

- Advisor:

- EQUITA SIM

The company

Mediobanca is an Italian banking group founded in 1946, active mainly in corporate & investment banking, wealth management and consumer banking. Listed on the Italian Stock Exchange, it operates both in Italy and abroad through a diversified and integrated business model serving companies, institutional investors and private clients. The bank is recognized for its capital strength and its role as a reference player in the Italian and European financial markets.

Banca Generali is an Italian private bank specializing in wealth management and financial advisory services. Founded in 1998 and listed on the Italian Stock Exchange, it is part of the Generali Group and operates nationwide through a network of financial advisors and private bankers. The bank provides investment solutions, wealth planning and advanced banking services, and is recognized as one of the leading players in the Italian wealth management sector.